GPS (Global Positioning System) technology is one of the most innovative inventions of our time. Its technological applications are almost ubiquitous in modern life. At the same time, GPS car trackers have become an important security feature for our cars. It allows car owners to monitor and track their cars’ real-time locations and status. With the introduction of GPS tracker devices, car insurance companies also benefit a lot. Let’s find out what can GPS trackers bring to car insurance companies.

More competitive with diversified Insurance programs

Thanks to the high-accuracy positioning module and 3-axis accelerometer inside, a GPS tracker can be installed or plugged into a vehicle to collect specific data about driving habits. Common data includes acceleration rate, drive speed, braking speed, and total miles driven. With the help of GPS trackers, car insurance companies are able to determine a highly-personalized premium and offer more attractive and competitive car insurance programs to their clients. For instance, Usage-based Insurance (UBI) programs establish rates based on how drivers use the cars, pay-per-mile insurance comprising of a base rate for insurance and an additional per-mile rate, etc.

Reduce the chance of claims due to vehicle theft

Many worrying statistics indicate that the car stolen rate remains stubbornly high. What’s worse, the vehicle is never recovered and the insurance company pays out a large claim. For car owners, it’s obvious that installing a car tracker is one of the most effective security methods to protect their vehicles from theft, as well as retrieving it in the event of it being taken. So, how to achieve that? Most GPS trackers, like our wired design series: TC01, TC02 and TC03, not only have multiple alerts including removal alarm, geo-fencing, tow alarm and etc, to prevent the car from stealing but also can remotely cut off the vehicle starter. Thus the stolen vehicle can be retrieved effectively. The benefit to car insurance companies is clear, that is, the chances of a vehicle theft claim will be greatly reduced!

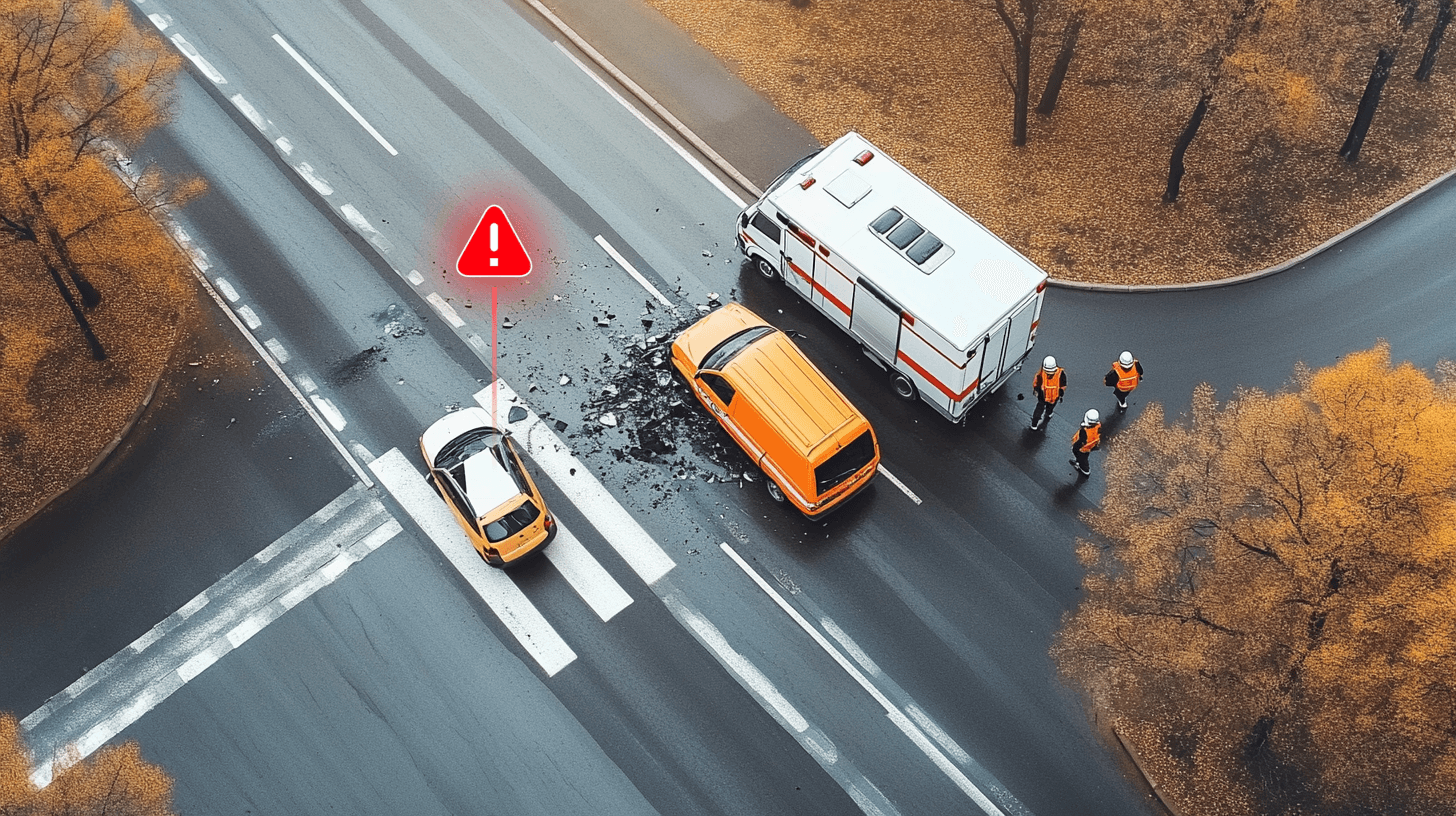

Encourage drivers to drive more safely

What’s the last thing car insurance companies want while offering insurance services to their clients. Yes, just as we mentioned before, the claims from insured vehicle accidents. Fewer claims mean more profits. Another benefit of GPS tracking is reducing the likelihood of accidents. With a user-friendly map service platform, insurance companies can clearly determine if drivers are safe drivers obeying the rules of the road, or if they are frequently speeding, running stop signs or other bad driving habits. The insurance company will use this data to set their rates. Accordingly, drivers who know they are being monitored by GPS tracking devices are driving more safely, they will intentionally adjust their behavior to improve their driving and, potentially, to avoid increasing insurance rates. This eventually leads to less likelihood of accidents.